Price to Book Value ratio

Price-Book Value ratio shows us how much we are paying for the given companies assets. A company’s assets include: real estate, plant, equipment, intellectual property, and brand. It also gives us a hint how much money would it take to recreate that business. This second part is actually borrowed from Peter Schiff. He pointed out that during the Dot-com bubble a lot of startups approached him for funding. The money that these startups with a webpage where asking for a small percentage of the business was ludicrous. Most of them did not have any profits, revenue, or even business plan how to make money. Regarding these companies Peter Schiff made the correct observation, that why would he pay millions of dollars for a company with a webpage and a few employees which he could recreate for less than 100.000 dollars.

This is a tail important to remember. Even if somebody has a great idea and creates a company, a different company based on the same idea can be recreated with enough funds, unless the people who created that company can continuously add value to that company, or the idea can be patented in some way.

Nescape was the first browser, Yahoo the first big search engine, and they were left behind by companies founded later, based on the same idea.

In any area, if huge value can be created, by investing little, in a free market, competitors will arrive. The company that hade the initial idea, does have a head start, but this is not enough reason to pay too much for it, compared to the money needed to create a similar company.

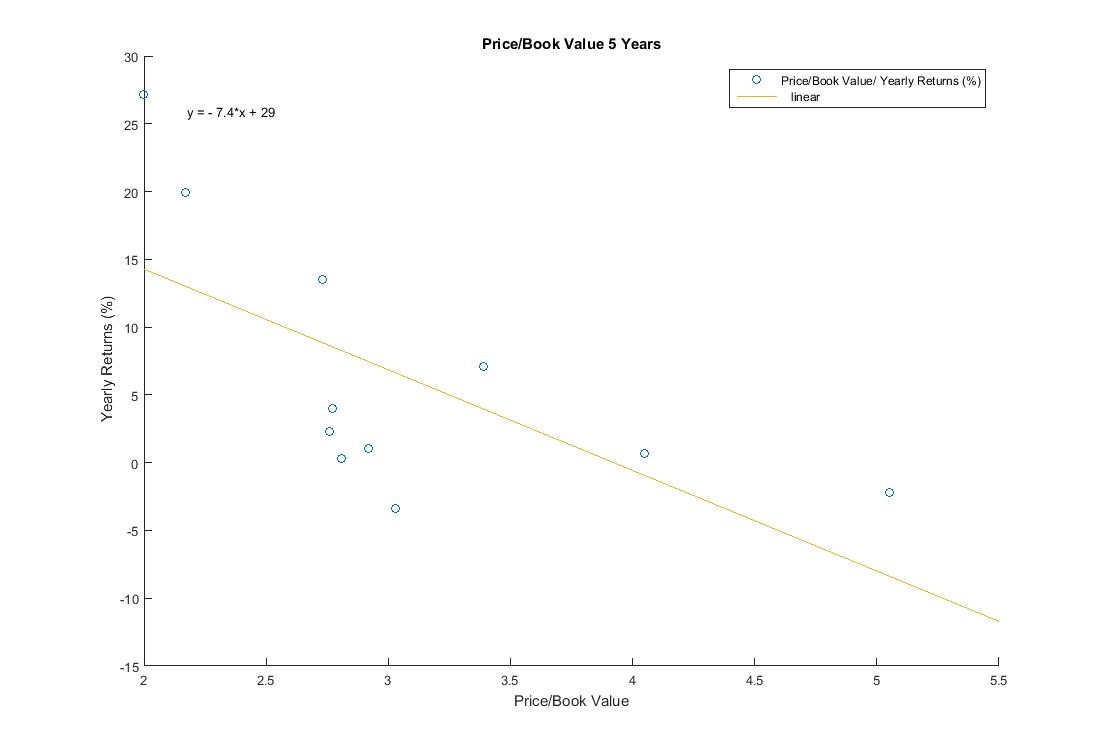

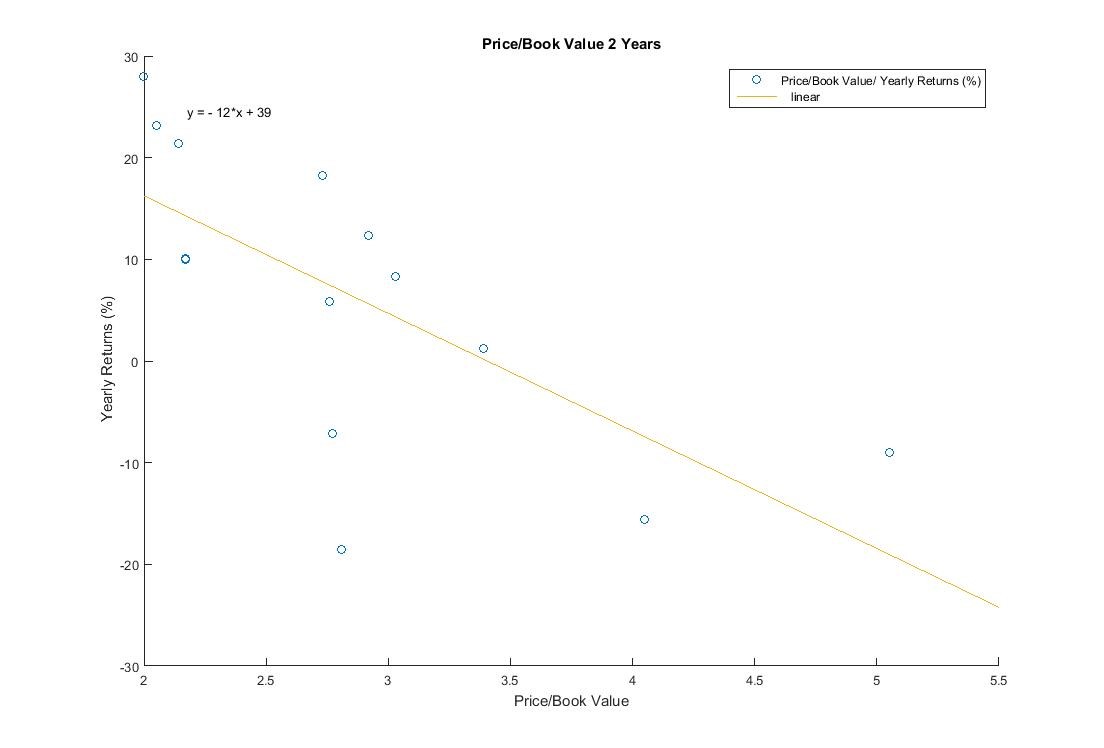

To examine the correlation between Price to Book Value ratio and returns in the following years we have quite limited data, starting from 2000 until 2015.

The correlation is quite strong for this metric. It is clear that the less we pay compared to the book value of the market the bigger the returns that we can expext.

What is ewen more shocking that this metric seem to work even on an one year invetment horizon, and works well for a three year invetment horizon as well.

Abowe 3 years invetment horizon the correlation is still strong, but why to use it in that manner if works bettet for one to three years.

Based on this annalysis, the lower the Price/Book Value the biger returns can we expect, in the coming years.

The highest Price to Book Value was reached in 2000 and it was 5. The mean and median values are near 2.75, and the minimum of 1.78 was touched in 2009.

The lowest Price/Book Value and the highest yearly return on years to come on this plot is from 2009 and truly the best time to buy in the last decade was 2009.

The highest Price/Book Value ratio is from 2000, an quite ovious the best time to sell in the past 20 years was 2000.

If we have bouth the index only under 2.75 Price/ Book value ratio, we wold have made between 0 and 35% returns yearly, no down year.

For longer periods we have even less data, however it seem that the market is fairly priced if the Price/Book Value ratio is below 2.75, and it is at fire sell below 2.

The 2007 boom ended wit the Price/Boock Value touching 3.

Currently this ratio is 2.85 and inching closer to the 3 mark. Can the market go up another nearly 100% and the Price to Book ratio go up above 5? Sure it can, but in that case we should expect a crash like the on started in 2000.

Based on the two year investment horizon if the Price/Book Value ratio is near 3 an investor in the S&P500 probably will lose money if he keeps his investments for two more years.

This means that the market would probably be lower in two years than it is today. Maybe it will go up another half year or even a year before the crash, but with high probability we have less than two years from this bull market.

A prudent investor should aim to invest when the market Price/Book Value ratio is at 2.75 or below.

This number probably differs for different indexes and different countries or industries but the correlation is quite clear.

Other analysis for this metric but for different indexes like the Dow, NASDAQ, and Russel 2000 can be expected shortly.